How AI and Bit Quantum Are Transforming the Market

The world of trading has undergone a significant transformation over the past decade, thanks to the rapid advancement of modern technologies. Artificial Intelligence (AI) and innovative platforms like Bit Quantum are revolutionizing trading practices, making them more efficient, data-driven, and accessible. These technologies provide traders with enhanced accuracy, automation, and predictive capabilities, reshaping traditional trading methodologies. In this article, we will explore the impact of AI on trading, the role of Bit Quantum in reshaping the industry, and how these technologies benefit traders worldwide.

Table of Contents

The Role of AI in Modern Trading

Artificial intelligence is transforming modern trading by providing data-driven insights, automating processes, and reducing risks. AI-powered tools enhance decision-making and improve trading strategies for both individuals and institutions. With machine learning, big data analytics, and predictive modeling, AI has significantly changed how traders operate, reducing human bias and enabling more accurate forecasts. These technologies empower traders by analyzing vast amounts of data in real-time, identifying profitable opportunities, and executing trades faster than traditional methods. The integration of AI-driven solutions ensures a more efficient, secure, and adaptive trading environment, benefiting both experienced investors and newcomers alike.

Artificial intelligence is transforming modern trading by providing data-driven insights, automating processes, and reducing risks. AI-powered tools enhance decision-making and improve trading strategies for both individuals and institutions.

1. AI-Powered Trading Algorithms

AI-driven trading algorithms have become a game-changer for investors. These sophisticated systems analyze vast amounts of market data in real-time, helping traders make informed decisions based on historical patterns, current trends, and predictive analytics. AI eliminates emotional bias, improving accuracy and efficiency in executing trades. Unlike human traders, AI can process large datasets instantaneously, identifying correlations and patterns that may go unnoticed. Additionally, AI-powered algorithms can execute high-frequency trades at speeds beyond human capabilities, ensuring optimal market entry and exit points. This level of automation enables traders to capitalize on fleeting opportunities, reduce risks, and enhance overall profitability.

2. Machine Learning in Market Predictions

Machine learning models are designed to adapt and improve over time. By continuously analyzing market fluctuations, news sentiment, and macroeconomic indicators, AI-powered trading tools can provide high-precision predictions, giving traders a competitive edge. These models use historical data to identify emerging trends and forecast future price movements with a higher degree of accuracy than traditional methods. Additionally, machine learning enhances risk assessment by detecting anomalies and potential market disruptions before they occur. The ability of AI to process real-time information from multiple sources—including social media trends, geopolitical events, and economic reports—further enhances predictive capabilities, allowing traders to make data-driven decisions with greater confidence.

3. Automation and Smart Trading Bots

Automated trading bots, powered by AI, execute trades at optimal times without human intervention. These bots follow predefined strategies, minimizing risks and maximizing profits. Traders benefit from 24/7 market monitoring and instant execution, reducing the likelihood of missed opportunities. AI-driven bots continuously scan the market, adjusting trading strategies based on real-time fluctuations. Unlike human traders who may be limited by emotional responses, AI ensures objective and consistent execution. Moreover, some smart bots utilize reinforcement learning, allowing them to refine their strategies over time for better accuracy. By leveraging automation, traders can diversify their portfolios, optimize trade execution, and reduce manual workload, making trading more efficient and less time-consuming.

Bit Quantum: The Future of AI Trading

Bit Quantum is at the forefront of AI-driven trading innovations, offering traders cutting-edge solutions for market analysis, automation, and risk management. The platform harnesses AI algorithms to provide deep insights into market trends, allowing users to make data-backed decisions with minimal effort. By leveraging advanced machine learning models, Bit Quantum continuously adapts to market fluctuations, ensuring optimal trade execution. Furthermore, its intuitive interface makes it accessible to both novice and experienced traders, eliminating barriers that have traditionally hindered entry into sophisticated trading strategies. As AI technology continues to evolve, Bit Quantum remains a leader in revolutionizing how trading is conducted on a global scale.

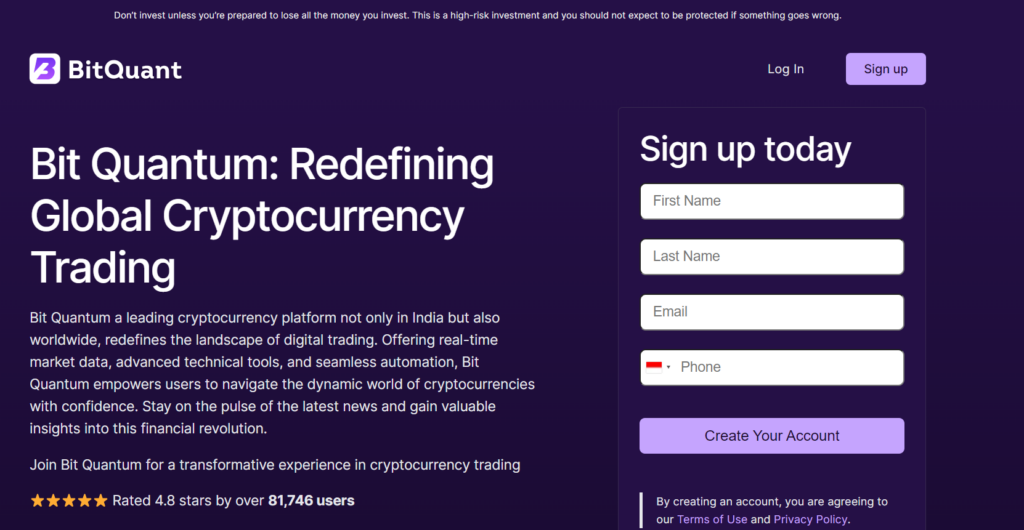

1. What Is Bit Quantum?

Bit Quantum is an advanced AI-powered trading platform that leverages cutting-edge technology to optimize trading strategies. It integrates real-time analytics, predictive modeling, and automation to help traders make more informed decisions with minimal effort. By analyzing vast amounts of market data, Bit Quantum identifies emerging trends and suggests optimal trading opportunities. The platform is designed to adapt to market fluctuations, providing users with highly accurate insights. Whether you’re a beginner or a seasoned trader, Bit Quantum offers a comprehensive suite of tools to enhance your trading experience and maximize profitability.

2. Key Features of Bit Quantum

- AI-Driven Market Analysis: The platform continuously scans the market, analyzing thousands of data points in real time to identify profitable opportunities. Advanced machine learning algorithms help detect market trends before they become widely apparent.

- Automated Trading Execution: Bit Quantum ensures fast and efficient trade execution based on AI algorithms, eliminating delays and reducing the risk of human error. The system can automatically buy and sell assets according to predefined strategies, optimizing trade performance.

- User-Friendly Interface: Designed for both beginners and experienced traders, the platform offers a seamless experience with intuitive dashboards, easy navigation, and customizable trading preferences.

- Risk Management Tools: AI-powered risk assessment features help traders mitigate potential losses. The system provides alerts and recommendations based on market volatility, ensuring users can make informed decisions.

- Customizable Trading Strategies: Traders can create and fine-tune AI-driven strategies based on their risk tolerance, preferred asset classes, and market conditions. This flexibility allows for a personalized trading experience.

3. Benefits of Using Bit Quantum

- Enhanced Accuracy: AI reduces errors in market predictions and trade execution by continuously learning from past data and improving its analytical capabilities.

- Time Efficiency: Automated processes save time and effort for traders, allowing them to focus on strategy development rather than manual trade execution.

- Accessibility: The platform is designed to be intuitive, making advanced trading accessible to everyone, regardless of their experience level.

- Increased Profit Potential: By leveraging AI-driven insights, traders can make more precise and profitable trades, maximizing their returns.

- 24/7 Market Monitoring: Unlike human traders, AI-powered systems work around the clock, ensuring that no trading opportunities are missed, even when the market shifts unexpectedly.

Use Cases of AI in Trading

Artificial intelligence is reshaping the trading landscape by enhancing decision-making, reducing human error, and providing real-time insights. AI’s ability to process large datasets at incredible speeds allows traders to capitalize on market opportunities that would otherwise go unnoticed. From predictive analytics to automated risk assessments, AI plays a vital role in optimizing trading strategies across different market sectors. Financial institutions, individual investors, and cryptocurrency traders all benefit from AI-powered tools, making trading more efficient and profitable. Below are some key use cases demonstrating the impact of AI in trading and how it is being implemented across various sectors.

1. Institutional Trading Firms

Large financial institutions use AI-driven platforms like Bit Quantum trading to manage vast portfolios efficiently. AI ensures faster transaction speeds and improved market analysis. By leveraging machine learning and predictive analytics, these firms can anticipate market movements, optimize asset allocation, and minimize risks. AI-powered risk assessment tools allow institutions to assess market volatility in real-time, ensuring better portfolio management. Additionally, AI-driven high-frequency trading (HFT) enables institutions to execute thousands of trades per second, capitalizing on microprice fluctuations that would be impossible for human traders to detect.

2. Retail Traders and Investors

Individual traders benefit from AI-powered tools by gaining insights and executing trades with precision. Platforms like the Bit Quantum app provide automated solutions, reducing the complexity of trading. AI-powered trading assistants help retail traders identify profitable opportunities by analyzing historical data, market trends, and real-time news. These systems eliminate emotional decision-making, ensuring rational trade execution based on statistical probabilities. Additionally, AI-based portfolio management tools offer customized investment strategies tailored to individual risk tolerance and financial goals. Retail investors can now leverage AI to enhance their trading efficiency, making the market more accessible to non-experts.

3. Cryptocurrency Trading

The volatile nature of cryptocurrency markets makes AI-powered tools essential for predicting price movements and executing trades at optimal times. AI-based trading bots help manage crypto investments with minimal manual intervention. These bots analyze vast amounts of blockchain data, social media sentiment, and global financial indicators to make real-time trading decisions. AI-driven arbitrage trading strategies allow traders to exploit price differences across multiple exchanges, maximizing profits. Furthermore, AI models detect patterns in price fluctuations, helping traders anticipate bullish and bearish trends before they happen. With AI, crypto traders gain a competitive edge by responding to market movements faster and more accurately than ever before.

Conclusion

The integration of AI into trading has reshaped financial markets, providing traders with enhanced tools for decision-making and automation. With its ability to analyze vast amounts of data, identify patterns, and execute trades with precision, AI has become an indispensable tool in modern trading. Platforms like Bit Quantum exemplify the future of AI-driven trading, ensuring accuracy, efficiency, and accessibility.

AI-driven technologies, including Bit Quantum, are transforming the trading industry by making it more efficient, accessible, and profitable. By reducing human error and optimizing trading strategies, AI provides a competitive advantage that was once reserved for large financial institutions. From AI-powered market analysis to automated trading execution, these innovations help traders stay ahead in a competitive market. If you’re looking to leverage AI for smarter trading, consider exploring Bit Quantum today.