How Grok AI is Revolutionizing the Industry

The trading landscape has undergone a dramatic transformation with the advent of modern technologies. Artificial Intelligence (AI), particularly advanced solutions like Grok AI Trading, is reshaping trading practices, improving efficiency, and optimizing decision-making. AI-driven tools offer traders unparalleled access to real-time data, predictive analytics, and automation, helping them make more informed and strategic choices in the financial markets.

In this article, we will explore the role of AI in trading, highlight the features and benefits of grokaitrading, discuss real-world applications, and consider the future of AI-driven trading solutions.

Table of Contents

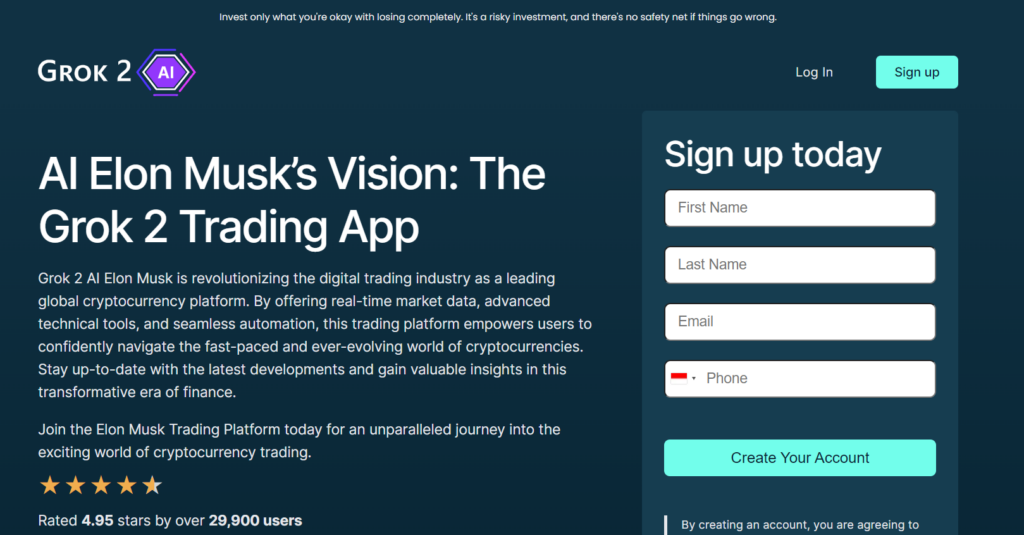

What is Grok AI?

Grok AI is a cutting-edge artificial intelligence system specifically developed to revolutionize trading by providing real-time market analysis, predictive insights, and automated decision-making tools. By utilizing advanced machine learning, natural language processing, and big data analytics, grokaitrading empowers traders to make more informed decisions, reduce risk, and optimize trading strategies.

In today’s fast-paced financial markets, human traders often struggle to keep up with the vast amount of data available. Grok AI bridges this gap by processing billions of data points per second, identifying patterns that may go unnoticed by human traders, and offering actionable insights in real time. Whether you are a day trader, a long-term investor, or a hedge fund manager, Grok AI provides the technological edge needed to stay ahead of the competition.

How Grok AI Stands Out from Other AI Trading Tools

Unlike many AI-driven trading tools that focus solely on historical data analysis, Grok AI incorporates multiple innovative features that make it a game-changer in the financial industry:

- Real-Time Market Analysis – continuously scans the markets, detecting price movements, trading volumes, and sentiment shifts to provide instant alerts and recommendations.

- Adaptive Learning Technology – Instead of relying on static algorithms, evolves and improves over time by learning from new data and adapting to changing market conditions.

- Deep AI-Driven Insights – Uses complex neural networks and predictive modeling to forecast trends with greater accuracy.

- Cross-Asset Trading Support – Works across multiple asset classes, including stocks, forex, commodities, and cryptocurrencies.

- News and Sentiment Analysis – Processes news articles, financial reports, and social media discussions to assess how public sentiment affects market trends.

By combining these features, Grok AI is not just an AI assistant—it acts as a sophisticated trading partner capable of executing data-driven trades at the speed and precision that human traders simply cannot match.

The Technology Behind Grok AI

Grok AI leverages state-of-the-art technologies to provide highly accurate predictions and automated trading strategies:

- Machine Learning (ML): Grok AI continuously refines its algorithms by analyzing historical and real-time data, improving its accuracy over time.

- Natural Language Processing (NLP): NLP capabilities allow to interpret and process global financial news, earnings reports, central bank statements, and even social media discussions to gauge market sentiment.

- Big Data Analytics: By analyzing massive datasets from multiple sources, Grok AI can uncover hidden correlations and patterns that drive market movements.

- High-Frequency Trading (HFT): For institutional traders, supports HFT strategies, executing thousands of trades per second based on micro-market movements.

Who Can Benefit from Grok AI?

Grok AI is designed for a wide range of traders and investors, including:

- Day Traders – Benefit from real-time market alerts and fast decision-making capabilities.

- Long-Term Investors – Utilize AI-driven fundamental analysis to identify undervalued assets.

- Hedge Funds & Institutions – Enhance portfolio management and risk assessment with AI-powered insights.

- Retail Investors – Gain access to professional-grade AI tools for better trading outcomes.

By offering a scalable solution that caters to both novice traders and seasoned professionals, Grok AI is setting a new standard for AI-powered trading platforms.

The Role of AI in Modern Trading

Artificial Intelligence has significantly changed the way trading is conducted. By utilizing vast amounts of data and machine learning models, AI enables traders to make data-driven decisions rather than relying on intuition or outdated methodologies. This shift has led to more accurate predictions, efficient market analysis, and automated trading strategies.

Benefits of AI in Trading

- Enhanced Market Analysis – AI processes large amounts of market data, detecting patterns and trends that human traders might overlook.

- Automated Trading – AI-driven bots execute trades based on pre-set parameters, reducing the potential for human error and emotion-driven decisions.

- Risk Management – AI tools assess market risks, alerting traders to potential downturns and helping them hedge against losses.

- Personalized Trading Strategies – AI adapts to individual trading styles, offering customized insights based on past trading behavior.

- Speed and Efficiency – AI can process millions of data points in milliseconds, allowing for rapid decision-making and trade execution.

- Sentiment Analysis – AI can analyze news articles, social media posts, and financial reports to gauge market sentiment and anticipate price movements.

Grok AI: A Game-Changer in Trading

Grok AI Trading is revolutionizing trading with its advanced AI capabilities. Designed to cater to both individual and institutional traders, Grok AI brings powerful automation and market insights that enhance trading efficiency and profitability. By leveraging machine learning and real-time analytics, it helps traders make data-backed decisions with greater confidence.

Features of Grok AI

- Predictive Market Insights – Grok AI analyzes historical and real-time data to forecast market trends with high accuracy.

- Algorithmic Trading – Automates buy/sell decisions based on intelligent pattern recognition, ensuring precise execution.

- Sentiment Analysis – Evaluates news, social media trends, and financial statements to assess market sentiment.

- Portfolio Optimization – Suggests asset allocation strategies to maximize returns while minimizing risk.

- Adaptive Learning – Continuously refines its predictions and recommendations based on newly acquired data.

- Customizable Trading Bots – Users can fine-tune Grok AI’s automated trading bots to align with their specific trading strategies.

Use Cases of Grok AI in Trading

The integration of AI into trading has created multiple practical applications that benefit traders across various domains. Here’s how Grok AI is being utilized:

1. Day Trading

Day traders require split-second decisions and real-time data to stay ahead of market fluctuations. Grok AI provides real-time market monitoring, ensuring traders can capitalize on profitable opportunities instantly.

2. Long-Term Investing

Investors focused on long-term growth rely on AI to identify undervalued assets and predict future market trends. Grok AI helps investors build and maintain a well-balanced, profitable portfolio.

3. Risk Mitigation

One of the biggest challenges in trading is mitigating risk. AI-powered tools like Grok AI analyze market volatility and historical trends to recommend strategies that minimize potential losses.

4. Cryptocurrency Trading

With the rise of digital currencies, cryptocurrency trading has become more complex. Grok AI analyzes blockchain activity, trading volumes, and price trends to determine the best trading opportunities.

5. Hedge Fund Management

Hedge funds benefit from AI’s ability to analyze large datasets from global markets. Grok AI aids in optimizing portfolio diversification and identifying high-potential investment opportunities.

6. Retail Trading

Retail traders, often at a disadvantage compared to institutional traders, can leverage Grok AI’s powerful analysis tools to compete on a more level playing field.

Challenges and Limitations of AI in Trading

Despite its advantages, AI-powered trading is not without challenges. Traders should be aware of these limitations to effectively navigate the AI-driven financial landscape.

- Data Accuracy – AI relies on high-quality data; inaccurate inputs can lead to erroneous predictions and flawed trading strategies.

- Market Volatility – Unexpected events such as economic crises or political instability can disrupt AI predictions.

- Regulatory Compliance – AI trading must adhere to financial regulations, which vary across different jurisdictions.

- Initial Costs – Deploying AI solutions requires significant investment in technology, infrastructure, and expertise.

- Over-Reliance on Automation – While AI enhances decision-making, human oversight remains essential to navigate unpredictable market conditions.

The Future of AI in Trading

The potential of AI in trading is vast and continues to evolve. As technology progresses, AI-driven trading solutions will become even more sophisticated, bringing enhanced efficiency and profitability to traders worldwide.

Expected Advancements:

- AI-Powered Hedge Funds – Fully autonomous hedge funds managed by AI, with minimal human intervention.

- Quantum Computing in Trading – Faster processing speeds and superior data analysis will enhance AI’s predictive capabilities.

- Blockchain Integration – AI-driven trading solutions incorporating blockchain technology for increased security and transparency.

- Voice-Activated Trading Assistants – AI assistants capable of executing trades based on natural language commands.

- Enhanced AI Ethics and Regulation – Stricter guidelines and improved AI ethics frameworks will ensure fair and responsible AI trading practices.

Conclusion

AI is undeniably transforming trading, offering unprecedented speed, efficiency, and predictive insights. Grok AI stands at the forefront of this revolution, equipping traders with cutting-edge tools to navigate complex financial markets. As AI technology advances, its role in trading will become even more pronounced, paving the way for a more data-driven and efficient market ecosystem. Explore the potential of AI-driven trading by integrating AI Trading into your investment strategy. For more insights and updates on AI-driven trading innovations, visit grokaitrading.it.