Trader AI The Future of Algorithmic and Automated Trading

The trading landscape has undergone a remarkable transformation with the advent of modern technologies. Artificial Intelligence (AI) and innovative digital solutions have reshaped trading strategies, providing traders with sophisticated tools to enhance decision-making, reduce risks, and optimize profits. In this article, we explore how AI-powered technologies, particularly Trader AI, are revolutionizing the trading industry.

Table of Contents

The Rise of Trader AI

Artificial Intelligence has significantly transformed the financial industry, particularly in trading. AI-driven solutions provide traders with powerful analytical tools, allowing them to make informed decisions faster and more accurately. By automating complex processes, AI reduces the likelihood of human error and optimizes trading efficiency. Below are some of the ways AI is revolutionizing trading practices.

How AI is Changing Trading Practices

AI enables traders to process vast amounts of data at unprecedented speeds, making real-time market analysis more accurate and efficient. Machine learning algorithms identify patterns, predict price movements, and automate trading strategies, reducing human intervention and emotional bias. Additionally, AI-driven platforms analyze news sentiment and global economic indicators, helping traders anticipate market shifts.

Key AI Technologies Used in Trading

- Machine Learning Algorithms – AI models analyze historical market data to forecast trends and suggest optimal trade actions.

- Natural Language Processing (NLP) – Extracts insights from financial news, earnings reports, and social media to provide a comprehensive market outlook.

- Predictive Analytics – Uses historical and real-time data to anticipate market fluctuations, allowing traders to adjust strategies proactively.

- Automated Trading Bots – Execute trades based on predefined conditions, reducing human error and improving efficiency.

- AI-Based Risk Assessment – Identifies and mitigates potential trading risks by analyzing market volatility and investment behaviors.

Benefits of AI-Powered Trading

AI-powered trading brings several advantages, from enhancing decision-making to improving efficiency and risk management. Traders leveraging AI tools can analyze vast amounts of market data in real time, enabling them to execute better-informed trades. The key benefits of AI-driven trading include:

Improved Decision-Making

AI-driven trading systems provide traders with real-time data analysis, improving decision accuracy and efficiency. AI eliminates emotional bias, ensuring decisions are based purely on data-driven insights. Traders can rely on AI-powered models to determine the best entry and exit points, maximizing profits.

Speed and Efficiency

AI-powered trading bots execute trades within milliseconds, capitalizing on market opportunities that human traders might miss. High-frequency trading (HFT) leverages AI to make rapid transactions, optimizing profit margins. This level of efficiency is crucial in volatile markets where timing is essential.

Risk Management

AI models assess potential risks by analyzing historical data and real-time market fluctuations. They detect anomalies and alert traders to potential pitfalls before significant losses occur. AI-driven risk assessment tools help traders develop diversified portfolios, minimizing exposure to market downturns.

Cost Reduction

Automation minimizes the need for human intervention, reducing operational costs and increasing profitability. AI-driven strategies optimize resources, ensuring efficient portfolio management. Firms using AI in trading can lower costs related to research, analysis, and trade execution.

Use Cases of AI in Trading

The application of AI in trading spans multiple areas, from market analysis to automated trading. AI tools empower traders with real-time insights, predictive analytics, and efficient execution strategies. Here are some prominent use cases of AI in trading:

AI for Market Analysis

AI-powered language models assist traders by analyzing financial reports, summarizing market trends, and generating insights based on real-time data. These models process vast amounts of financial information, making it easier for traders to identify profitable opportunities.

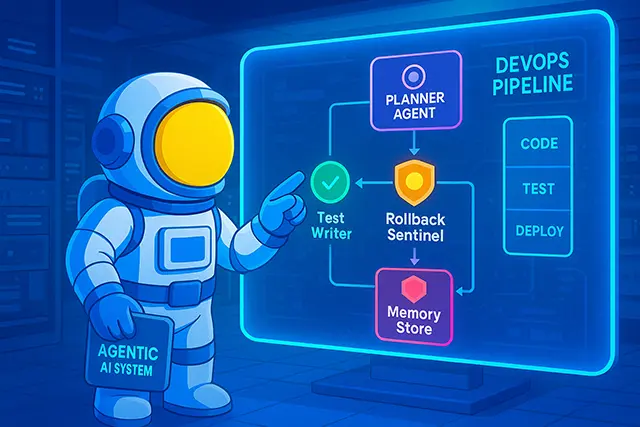

AI in Algorithmic Trading

Algorithmic trading platforms use AI to develop and execute trading strategies without manual intervention. These algorithms analyze market data, identify profitable opportunities, and execute trades at optimal times. AI-driven trading systems continuously adapt and refine their strategies based on evolving market conditions.

Sentiment Analysis for Trading Decisions

AI-powered sentiment analysis tools assess public sentiment from news articles, social media, and financial blogs, helping traders make informed decisions based on market psychology. By understanding investor sentiment, traders can anticipate market movements more effectively.

AI for Portfolio Management

AI-driven investment platforms analyze financial data to create personalized portfolio recommendations. These systems help traders diversify investments and optimize asset allocation based on risk tolerance and market trends.

Challenges and Considerations

Despite its many advantages, AI in trading is not without challenges. Issues such as data privacy, over-reliance on historical data, and ethical concerns must be addressed to ensure responsible and effective AI adoption in trading. Below are some critical considerations for AI-driven trading:

Data Privacy and Security

With increased AI integration, concerns regarding data security and privacy arise. Ensuring compliance with regulatory frameworks and using secure platforms are essential for safe AI-driven trading. Traders must protect sensitive financial information from cyber threats.

Dependence on Historical Data

AI models rely on historical data for predictions, which may not always accurately reflect future market conditions, particularly during unprecedented events like economic crises. Traders should use AI insights as a guide rather than a definitive solution.

Ethical Considerations

AI-powered trading introduces concerns about market manipulation and fairness. Regulatory bodies are continually updating guidelines to ensure ethical trading practices. It is essential for traders and financial institutions to adhere to ethical AI use in trading.

The Future of AI in Trading

AI’s role in trading is set to expand further with advancements in deep learning, blockchain integration, and quantum computing. As AI technology becomes more sophisticated, traders will gain access to even more advanced tools for market analysis, risk management, and automated trading. Here’s what the future holds for AI in trading:

- Integration with Blockchain – AI combined with blockchain technology enhances transparency and security in trading transactions.

- Quantum Computing in Trading – The application of quantum computing in AI trading models will increase computational power, improving predictive accuracy.

- AI-Powered Robo-Advisors – Personalized AI investment advisors will provide automated financial planning and asset management.

- Enhanced AI Regulation – Governments and financial institutions will implement stricter AI regulations to ensure ethical and fair trading practices.

How to Choose the Right AI Trading Platform

With numerous AI trading platforms available, selecting the right one can be challenging. Here are some key factors to consider:

Reliability and Accuracy

Look for a platform with a proven track record of accurate market predictions and robust AI algorithms. Platforms like traderaiplattform.de offer advanced analytics, high-precision forecasting tools, and real-time market insights.

User-Friendliness

A trading platform should have an intuitive interface, real-time charting tools, and automated trade execution. Platforms should cater to both beginners and experienced traders by offering customizable dashboards and easy navigation.

Security and Compliance

A reliable AI trading platform must follow strict security protocols, including encryption, multi-factor authentication, and compliance with financial regulations. Platforms should also be registered with regulatory bodies to ensure fair trading practices.

Customization Options

AI trading platforms should allow users to tailor strategies based on risk tolerance, asset preferences, and market conditions. Advanced platforms offer backtesting features, allowing traders to test strategies on historical data before executing trades.

Conclusion

The adoption of AI in trading is transforming the industry, offering traders unparalleled advantages in decision-making, efficiency, and risk management. Trader AI and other innovative solutions provide a competitive edge, making trading more accessible and data-driven. As technology continues to evolve, embracing AI-powered tools will be crucial for staying ahead in the ever-changing financial markets.