A Deep Dive into Neoprofit Trading Technologies

The financial trading landscape has undergone profound changes over the past decade, driven primarily by rapid advancements in technology. Among these innovations, artificial intelligence (AI) has emerged as a pivotal force, fundamentally reshaping trading practices across global markets. The rhythm of trading has quickened, and new tools have become available, allowing traders to make more informed decisions and enhance their profitability. This article will explore how platforms like Neoprofit are leveraging modern technologies to enhance trading strategies, streamline decision-making processes, and maximize returns. Throughout this examination, we will analyze the features, benefits, challenges, and real-world implications of these innovative tools for traders, aiming to provide a comprehensive understanding of their significance in today’s fast-paced trading environment.

Table of Contents

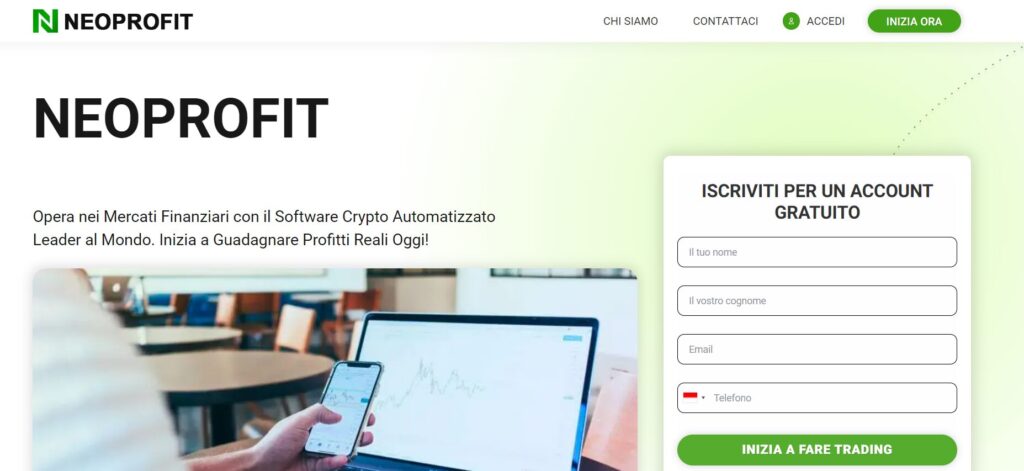

Understanding Neoprofit and Its Role in Modern Trading

Neoprofit is a cutting-edge trading platform specifically designed to integrate AI-powered tools that facilitate informed decision-making for traders. By employing sophisticated algorithms and machine learning techniques, Neoprofit can analyze vast amounts of market data, delivering actionable insights that empower users to optimize their trading strategies effectively. As financial markets become increasingly complex and information-rich, tools like neoprofitapp.com serve as indispensable allies for traders seeking to navigate this landscape and achieve their financial goals.

The Rise of AI in Trading

The adoption of AI technologies in trading has revolutionized the financial industry. For decades, traders relied primarily on intuition, technical analysis, and manual data interpretation to guide their decisions. However, with the introduction of AI, the focus has shifted toward data-driven trading strategies that provide insights in real time. AI’s rapid processing capabilities enable it to analyze market data quickly, identify patterns, and execute trades at unprecedented speeds. This evolution provides traders with major advantages in their quest for success.

Core Features of Neoprofit

Neoprofit stands out in the crowded landscape of trading platforms due to its user-friendly interface and a comprehensive suite of powerful features designed to improve trading outcomes. Here are the core functionalities that differentiate Neoprofit from others in the market:

- Real-Time Market Analysis Neoprofit provides users with instantaneous insights into market trends. This feature allows traders to access real-time data, enabling them to make quick and informed decisions based on the latest market conditions. In an environment where timing is critical, this responsiveness is invaluable.

- Algorithmic Trading One of the standout features of Neoprofit is its algorithmic trading capabilities. Traders can develop and implement customized trading algorithms that execute trades automatically based on predefined parameters. This automation minimizes the chances of human error and allows traders to seize opportunities without the delays associated with manual trading.

- Risk Management Solutions Effective risk management is a cornerstone of successful trading. Neoprofit offers tools that help traders assess potential risks and manage their exposure, providing alerts and recommendations based on market volatility and individual trading patterns. This proactive approach allows traders to make informed decisions, effectively safeguarding their investments.

- User Education and Resources Neoprofit recognizes that knowledge is critical for successful trading. The platform provides a variety of educational resources, including tutorials, webinars, and market analysis, to enhance users’ understanding of trading strategies and technologies. This emphasis on education empowers traders to make confident decisions backed by solid knowledge.

- User-Friendly Interface Neoprofit features an intuitive user interface that makes it accessible to traders of all experience levels. The platform is designed to streamline the trading process, with customizable dashboards and user-friendly navigation that help traders focus on what they do best trading.

The Benefits of AI Technologies in Trading

The integration of AI technologies is not just a passing trend; it is a transformative force that brings numerous benefits to traders. Below are several key advantages that AI technologies provide:

- Enhanced Decision-Making AI tools utilize complex algorithms to analyze vast datasets, incorporating historical data, current market conditions, and multiple variables. This level of analysis enhances traders’ decision-making capabilities by allowing them to identify patterns, predict potential price movements, and mitigate risks associated with market uncertainties.

- Increased Efficiency The automation of trading processes through algorithms allows for quicker execution of trades, minimizing delays inherent in human decision-making. In highly liquid markets, where prices can change in the blink of an eye, this efficiency is critical. Traders can act swiftly to capitalize on opportunities created by price fluctuations.

- Advanced Data Analysis AI-driven platforms like Neoprofit can process and analyze massive datasets from diverse sources, including financial news, social media trends, and market reports. By synthesizing these various data points, traders can gain insights into market sentiment and trends that inform their trading strategies.

- Improved Accuracy Relying on data-driven insights significantly increases the accuracy of trading predictions. AI technologies can remove much of the emotional bias that affects decision-making. This results in more consistent trading outcomes that are rooted in data rather than influenced by psychology and emotions.

- Adaptability to Market Changes Markets are continually evolving, driven by news, events, and sentiment shifts. AI algorithms are designed to learn from data continuously, adapting their strategies based on the information at hand. This adaptability ensures that trading strategies stay relevant and effective, giving traders a significant edge in a constantly changing landscape.

- Scalability One of the compelling benefits of using AI in trading is scalability. Algorithms can execute multiple trades simultaneously across various markets and instruments. This scalability allows traders to diversify their portfolios effectively and manage larger volumes of trades than would be possible through manual trading.

Use Cases of Neoprofit in Trading

Neoprofit offers several practical applications that demonstrate its capabilities as a modern trading platform. Below, we highlight key use cases that showcase the platform’s features in action:

Algorithmic Trading

Neoprofit allows traders to develop and implement algorithmic trading strategies tailored to their individual preferences and risk tolerances. Users can set rules for when to enter and exit trades based on specific indicators or market conditions. For instance, a trader might configure an algorithm to buy a particular stock once its moving average crosses above a certain threshold (a common technical analysis signal). This automated trading process not only minimizes emotional decision-making but also enhances efficiency, allowing traders to seize lucrative opportunities without delay.

Sentiment Analysis

Understanding market sentiment is vital for making informed trading decisions. Neoprofit employs advanced AI to analyze data from various sources, including news articles, social media posts, and financial reports. By gauging public sentiment regarding specific stocks or market trends, traders can anticipate movements in market prices. For example, if social media sentiment is overwhelmingly positive about a tech company’s upcoming product launch, traders can position themselves advantageously to capitalize on any price increase driven by market enthusiasm.

Portfolio Management

Effective portfolio management is critical for sustained trading success. Neoprofit offers intelligent portfolio management tools that dynamically adjust investments based on changing market conditions. The platform continuously monitors performance metrics and executes adjustments in real time. For instance, if one asset class begins to underperform while another sector shows promising growth potential, Neoprofit can shift allocations automatically, ensuring that traders maintain optimized portfolios without manual intervention.

Predictive Market Modeling

By leveraging complex machine learning algorithms, Neoprofit can analyze historical price movements, trading volumes, and other market factors to forecast potential price changes. Screened for reliability, these predictive models allow traders to plan their strategies proactively. For example, if the platform’s modeling indicates an approaching bullish trend for a particular currency pair, traders can position themselves to benefit from anticipated price appreciation.

Overcoming Challenges in Trading with Neoprofit

While modern technology offers numerous advantages, traders must also navigate various challenges inherent in the trading landscape. Neoprofit addresses these challenges directly by providing tools that simplify the complexities often faced in trading:

Emotional Trading

One of the significant challenges traders face is emotional decision-making, which can lead to suboptimal performance. Neoprofit mitigates this risk by providing data-driven insights and analytics that guide decision-making. By removing the emotional component from trading, traders can focus on executing their strategies based on established parameters rather than being influenced by anxiety, fear, or excitement.

Information Overload

Traders often grapple with an overwhelming amount of data that can cloud their judgment. Neoprofit helps streamline information by curating relevant insights and presenting them clearly. Instead of sifting through countless sources, traders can access concise analyses that illuminate critical trends, helping them make informed decisions without the noise of irrelevant information.

Market Volatility

The inherently volatile nature of financial markets can pose challenges for traders. Neoprofit’s advanced risk management tools continually monitor market conditions and alert users to any unusual price movements or market events. This enables traders to react promptly to changes and implement protective measures, such as executing stop-loss orders, to safeguard their investments.

Cybersecurity and Data Privacy

As trading becomes increasingly digital, concerns around cybersecurity and data privacy are paramount. Neoprofit addresses these concerns through robust cybersecurity measures, including data encryption, secure access protocols, and regular audits. This approach helps ensure that user data remains private and secure, building trust in the platform.

1. Case Studies and Testimonials

Incorporating detailed case studies from traders who have successfully utilized Neoprofit can provide valuable insights into its real-world applications. For instance, consider sharing the story of a trader named David, who started using Neoprofit six months ago. Initially uncertain about employing AI-driven tools, David soon experienced significant improvements in his trading outcomes. After consistently leveraging Neoprofit’s algorithmic trading feature and its predictive market modeling tools, he reported a 50% increase in his investment portfolio and enhanced confidence in his trading decisions. Providing metrics, quotes, and specific strategies will enrich the narrative and help readers visualize success through Neoprofit.

2. Future of AI in Trading

Discussing the future implications of AI in trading can captivate readers’ interests and encourage them to think critically about upcoming trends. Explore potential developments such as deeper integrations of blockchain technology with trading platforms, which can enhance transparency and reduce transaction costs. Predict the rise of AI-driven trading mentors that personalize recommendations based on individual trader behavior, preferences, and portfolios. Speculate on the role of augmented and virtual reality technologies, which could revolutionize how traders interact with market data, offering immersive environments for analysis and decision-making.

3. Expert Opinions

Gathering insights from reputable industry experts can greatly enhance the credibility of the article. Seek out well-respected financial analysts, trading educators, and successful investors for their perspectives on the impact of AI in trading. Their opinions on future trends, the importance of data-driven decisions, and the democratization of trading through technology can enrich the content and provide readers with authoritative viewpoints.

4. Comparison with Traditional Trading

Create a comprehensive comparison between AI-driven trading strategies and traditional methods to highlight the distinct advantages of modernization. Use specific metrics such as return on investment (ROI), win rates, and time spent on analysis to underscore the performance differences. Incorporating case studies that juxtapose the trading results of AI-assisted strategies against those reliant on traditional techniques will add depth to this analysis. A visually appealing chart summarizing the comparisons will enhance readability and facilitate comprehension.

5. Troubleshooting and Support

Including a helpful guide on potential issues that traders might encounter while using Neoprofit can significantly improve user experience. Offer practical troubleshooting tips for common errors, explain how to access support features such as live chat and help centers, and create a FAQ section based on frequent inquiries from new users. By equipping users with solutions readily at hand, Neoprofit can further enhance user satisfaction, making it a go-to choice for traders seeking robust trading platforms.

Conclusion

The integration of modern technologies like AI into trading through platforms such as Neoprofit signifies a monumental evolution in trading practices. As the financial landscape continues to evolve, traders equipped with AI-enhanced tools can enjoy improved decision-making, enhanced efficiency, and effective risk management. By embracing these innovations, traders stand to gain a competitive edge in today’s fast-paced trading environment.