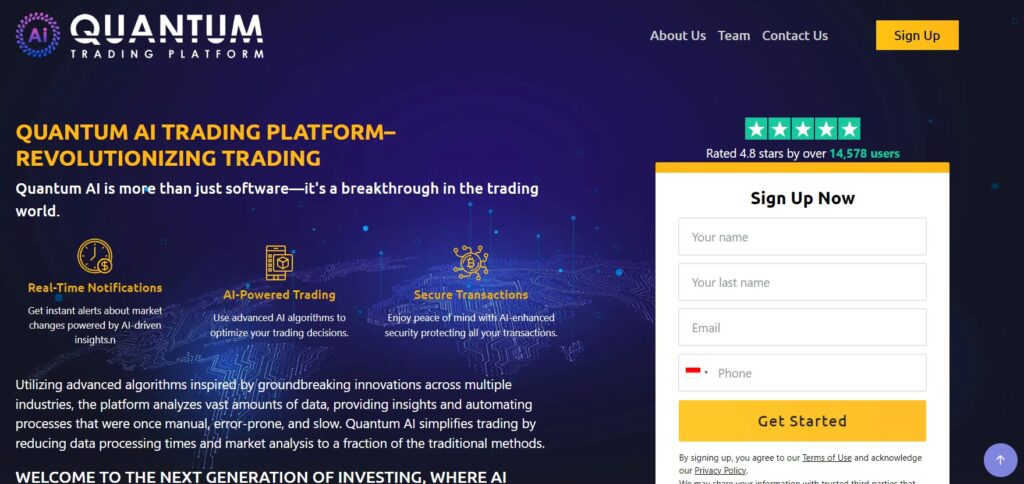

Quantum AI Modern Technology in Trading

The trading landscape has undergone significant transformations over the years, driven by advancements in technology. Today, artificial intelligence (AI) plays a pivotal role in modern trading, optimizing strategies and enhancing decision-making processes. Among the most promising innovations in this field is Quantum AI an emerging technology poised to revolutionize the financial markets. By leveraging the power of quantum computing, Quantum Ai platform is setting new standards for trading systems, improving speed, accuracy, and predictive capabilities.

In this article, we will explore how Quantum AI is reshaping trading practices, provide real-world use cases, and examine the benefits it brings to traders, financial institutions, and the broader market.

Table of Contents

The Rise of Quantum AI in Trading

Quantum AI is transforming the trading industry by merging the capabilities of quantum computing with artificial intelligence. This innovative combination enables unprecedented levels of processing power, helping traders make faster, more accurate decisions. As traditional AI systems have already brought significant advancements to the market, AI takes it a step further by leveraging quantum mechanics to solve complex problems that were previously out of reach for conventional computing. The rise of AI in trading holds the promise of reshaping strategies, improving prediction accuracy, and enhancing the overall efficiency of trading systems.

What is Quantum AI?

Quantum AI combines the principles of quantum computing with artificial intelligence, creating a hybrid system capable of solving complex problems at speeds far beyond the capability of traditional computers. Quantum computing uses the principles of quantum mechanics—such as superposition and entanglement to process information in parallel, enabling it to tackle complex tasks that would otherwise take years to solve using classical computing methods.

When integrated with AI, quantum computing accelerates machine learning algorithms, allowing for faster analysis and more accurate predictions. This makes AI a powerful tool for the financial sector, particularly in the realm of trading.

How Does Quantum AI Work in Trading?

Quantum AI uses quantum algorithms to perform massive calculations in real-time. These algorithms can analyze vast amounts of market data, identify patterns, and predict future market trends with high precision. Traditional AI systems rely on classical computers, which can only process data sequentially, while AI can process multiple data points simultaneously, speeding up the decision-making process.

By using quantum-enhanced AI models, traders can make better-informed decisions, optimize trading strategies, and gain a competitive edge. This technological leap offers several advantages, such as:

- Improved speed and accuracy in predictions.

- Enhanced ability to identify market patterns.

- More robust risk management strategies.

Benefits of Quantum AI in Trading

Quantum AI offers several advantages that can dramatically transform trading strategies and enhance overall performance. By merging the power of quantum computing with artificial intelligence, this technology allows for faster processing of complex data, more accurate predictions, and more efficient risk management. The following benefits illustrate how AI is helping traders gain a competitive edge and optimize their trading practices.

1. Faster and More Efficient Decision-Making

One of the most significant advantages of AI in trading is its ability to analyze data and make decisions at unprecedented speeds. Traditional AI tools can process data in minutes or hours, but quantum computing enables real-time analysis, making it possible to respond to market fluctuations almost instantaneously. This capability allows traders to execute strategies quickly, reducing the risk of missed opportunities.

Example:

A quantum-powered trading algorithm can process data from thousands of stocks and financial instruments, identifying trading signals within milliseconds, and executing buy or sell orders without delay.

2. Advanced Predictive Analytics

Predicting market trends is a core challenge for traders. While conventional AI models can forecast market movements based on historical data, AI enhances this ability by considering more variables and processing more complex scenarios. Quantum computing enables machine learning models to consider multiple scenarios simultaneously, improving their accuracy and reliability.

Example:

In stock trading, Quantum AI can predict how various factors such as global economic events, political developments, and market sentiment might influence stock prices. By processing these factors in parallel, AI can generate more accurate forecasts, helping traders make better-informed decisions.

3. Risk Management and Optimization

Risk management is a key concern for any trader, and AI provides powerful tools to manage risks effectively. AI can simulate and optimize trading strategies under various market conditions, allowing traders to assess potential risks and rewards before executing their trades.

Example:

Quantum algorithms can help investors assess the potential risk of an asset or portfolio by simulating different market conditions. This enables traders to determine the optimal trading strategy to minimize risk and maximize returns.

4. Competitive Advantage

Financial institutions and hedge funds that adopt AI gain a significant edge over competitors still relying on traditional methods. AI’s ability to process large datasets faster and more accurately enables these firms to make smarter, data-driven decisions that lead to more successful trades.

Real-World Use Cases of Quantum AI in Trading

The potential of Quantum AI in trading is already being realized in several high-impact use cases, where its speed and computational power are applied to solve some of the industry’s most complex challenges. From portfolio optimization to fraud detection, AI is transforming the way financial institutions and traders approach the markets. Here are some notable examples of how this cutting-edge technology is being used in real-world trading environments.

1. Portfolio Optimization

Quantum AI has already been used to enhance portfolio optimization, where traders and investment managers strive to balance risk and return. By simulating a variety of market conditions and using quantum-enhanced optimization algorithms, AI can help create more efficient portfolios.

Example:

A hedge fund uses Quantum AI to analyze millions of potential portfolio combinations, selecting the one with the highest probability of maximizing returns while minimizing risk, based on real-time market data.

2. Algorithmic Trading

Algorithmic trading using computer programs to automatically execute trades based on predefined criteria has been a significant component of modern financial markets. Quantum AI has the potential to significantly improve algorithmic trading by processing vast amounts of data faster and making more accurate predictions.

Example:

A trading firm uses Quantum AI to adjust its trading algorithms on the fly, taking into account market conditions, news events, and sentiment analysis to maximize profits.

3. Fraud Detection and Market Manipulation

Quantum AI can be used to detect fraudulent activities and market manipulation by analyzing large datasets for irregular patterns and anomalies. Its ability to process complex data in real time makes it an invaluable tool for ensuring the integrity of financial markets.

Example:

A financial institution uses Quantum AI to monitor transactions for signs of fraud or manipulation, identifying suspicious behavior in real-time and preventing potential losses.

Challenges and Future Potential of Quantum AI in Trading

While Quantum AI holds immense promise for the future of trading, its widespread adoption is not without challenges. From the current limitations of quantum hardware to the complexity of integrating quantum systems with existing infrastructures, the road ahead requires overcoming several significant hurdles. However, the future potential of Quantum AI remains bright, with ongoing advancements in quantum computing paving the way for new and innovative applications in the financial sector.

Challenges

- Quantum Hardware Limitations

Quantum computing is still in its early stages of development, and current quantum processors are not yet capable of handling the massive datasets required by large financial institutions. Many quantum systems face limitations in terms of qubit stability, error rates, and processing power, which makes large-scale implementation of Quantum AI challenging. - Complexity of Integration

Integrating quantum algorithms into existing trading systems is a complex process that requires highly specialized knowledge. Many financial institutions are not equipped with the expertise to effectively implement Quantum AI solutions, which may hinder adoption. Furthermore, legacy systems may need to be overhauled to accommodate these advanced quantum technologies. - Cost and Accessibility

The infrastructure required to support Quantum AI—such as quantum computers and specialized hardware—is expensive. For smaller firms or individual traders, access to this technology may be out of reach, creating a disparity between larger financial institutions and smaller market players. - Regulatory and Security Concerns

The rise of Quantum AI could lead to new challenges in terms of cybersecurity and regulatory frameworks. Quantum computing’s ability to break existing cryptographic systems could pose risks to the security of financial transactions, prompting the need for new forms of encryption and robust security protocols.

Future Potential

Despite the current challenges, the future of Quantum AI in trading looks incredibly promising. As quantum hardware continues to improve and more powerful quantum algorithms are developed, the capabilities of Quantum AI will expand exponentially. Below are some of the exciting potential advancements:

- Breakthroughs in Quantum Algorithms

As quantum computing evolves, so too will the algorithms that power Quantum AI. With more advanced algorithms, Quantum AI could lead to significant improvements in market predictions, asset management, and trading strategies, helping firms stay ahead of market trends. - Democratization of Quantum AI

The cost of quantum computing is expected to decrease over time as the technology matures, making it more accessible to smaller firms and individual traders. The democratization of Quantum AI could level the playing field, allowing more players in the financial market to benefit from its advantages. - Wider Adoption Across Financial Markets

As Quantum AI becomes more reliable and easier to implement, it’s likely that more financial institutions will begin adopting it. This wider adoption could lead to faster market response times, better risk management, and improved portfolio optimization techniques. - Enhancing Financial Security

The next generation of Quantum AI may also help improve financial security. By developing quantum encryption methods and robust security protocols, financial institutions can better protect sensitive data from cyber threats and fraud, while also complying with emerging regulatory standards.

Conclusion

Quantum AI represents the next frontier in trading technology, offering traders, financial institutions, and investors the ability to make faster, more accurate decisions, optimize trading strategies, and better manage risks. Although it is still an emerging technology, its transformative impact on the financial sector is undeniable.

As Quantum AI continues to evolve, we can expect it to drive innovation in trading practices, providing a competitive edge for those who embrace it. For those looking to stay ahead of the curve, understanding and adopting Quantum AI will be essential in navigating the future of trading.