The Ultimate Guide to Bollinger Bands Trading Strategy

Ever thought of expanding your toolkit for cryptocurrency trading? Would you like to explore a proven, time-tested method that might just give you an edge in predicting market trends? If you’re nodding in agreement, then the Bollinger Bands trading strategy is exactly what you need to learn right now.

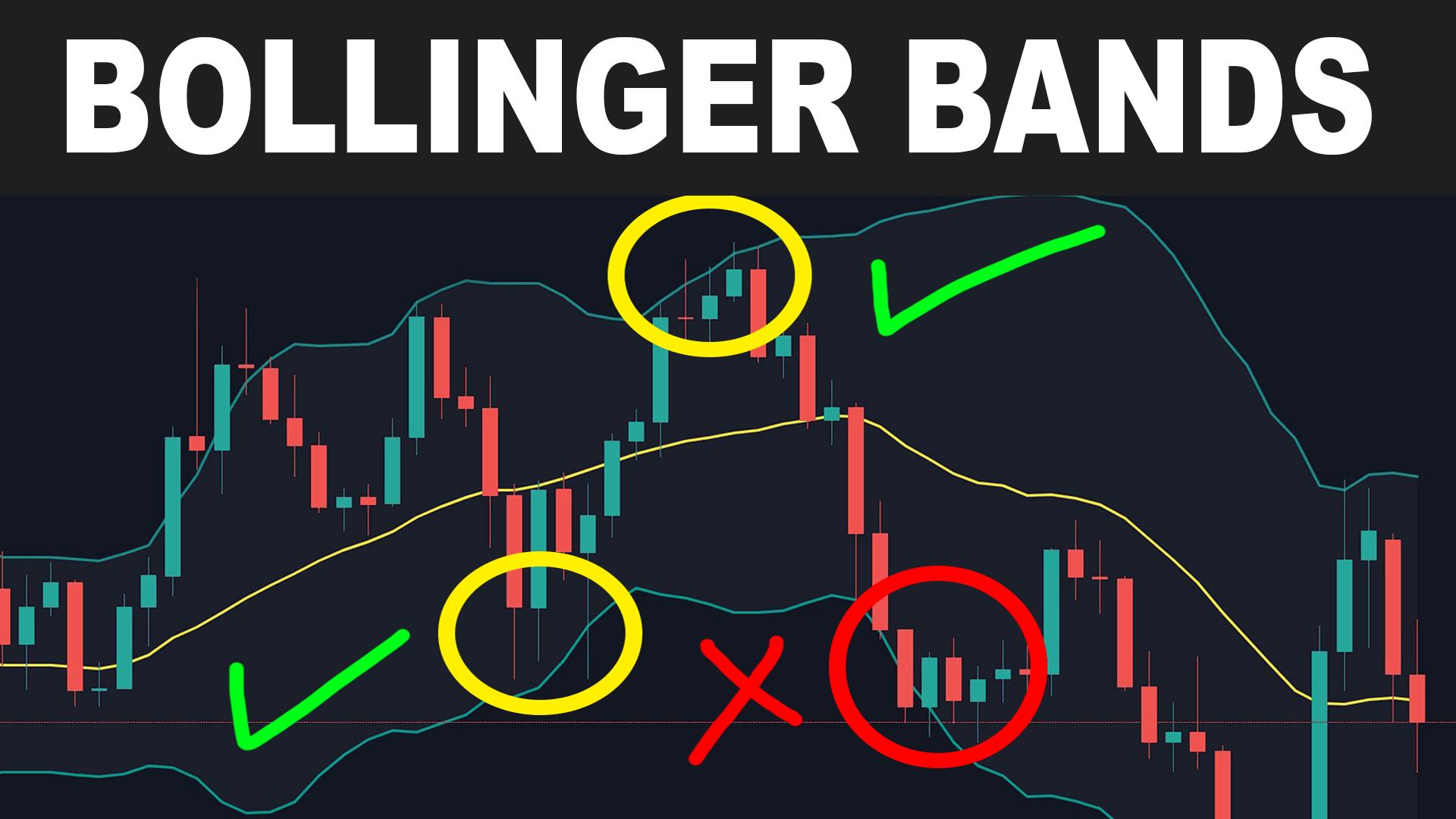

Used extensively by traders worldwide, the Bollinger Bands provides a visual representation of price volatility and trends over a certain period. It’s like having a crystal ball that may just foresee market movements and help you make informed decisions. Pretty cool, right?

In this article, we’ll dive deep into what Bollinger Bands are, how they work, and most importantly, how you can use them in your trading strategy. So, whether you’re a seasoned trader or a beginner just starting your crypto journey, there’s definitely something valuable for you here.

“The Bollinger Bands trading strategy: An excellent tool in your cryptocurrency trading arsenal. Discover how to use it effectively.”

Table of Contents

Understanding Bollinger Bands trading strategy: A Beginner’s Guide

Bollinger Bands are a type of statistical chart characterizing the prices and volatility over time of a financial instrument or commodity. These bands are an indicator that traders use to assess whether prices are high or low on a relative basis, and thus, they have become a highly valued tool among savvy traders.

They are made of three lines. The middle line is a Simple Moving Average (SMA) of the security’s price, while the upper and lower are deviations from this average. Let’s break down what this means.

- Simple Moving Average: An SMA is a calculation that takes the average price of a security over a specific number of periods.

- Upper Band: Calculated by adding a set number of standard deviations to the SMA.

- Lower Band: Calculated by subtracting a set number of standard deviations from the SMA.

The ‘standard’ settings for Bollinger Bands are a 20 day period with two standard deviations, denoted as (20,2). However, these settings can be adjusted to fit any market circumstances or personal trading style.

Let’s take a look at a simple illustration:

| Period | Close | SMA (20) | Upper Band (20,2) | Lower Band (20,2) |

|---|---|---|---|---|

| 1 | 105 | 105 | 105.98 | 104.02 |

| 2 | 108 | 107.25 | 108.5 | 106 |

| 3 | 110 | 108.33 | 110.42 | 106.25 |

| 4 | 109 | 109 | 109.96 | 108.04 |

The upper and lower bands widen or narrow (or squeeze) based on the volatility; they widen during periods of high volatility and narrow during low volatility. This is particularly helpful to cryptocurrency traders as they navigate the often turbulent market environment.

Remember, as you delve into the exciting world of trading, Bollinger Bands aren’t a standalone system. They should be used in conjunction with other trading tools and indicators for best results.

Key takeaways:

- Bollinger Bands consist of a Simple Moving Average (SMA) and an upper and lower band.

- These bands reflect price volatility – they widen during periods of high volatility and narrow during low volatility.

- For optimal performance, Bollinger Bands should be used together with other trading instruments.

Demystifying Bollinger Bands: An Overview

Bollinger Bands are a critical technical analysis tool that can help cryptocurrency traders make informed decisions. Invented by John Bollinger in the 1980s, Bollinger Bands consist of a simple moving average (SMA) line, with two standard deviation lines plotted above and below it. These bands create a range that cryptocurrency prices typically follow, helping traders identify potential moments of volatility, overbought/oversold conditions, and signal potential buy or sell opportunities.

The ideology guiding the Bollinger Bands is that price levels revert to the mean, or average, over time. The SMA forms the center or the ‘mean’. But market conditions aren’t always stable, which is where the two other lines, the ‘bands’, come into play. The bands contract and expand based on market volatility. Simply put, the wider apart the bands, the greater the volatility and hence, the larger the potential price movements.

Bollinger Bands are most valuable in trending markets, where price levels tend to oscillate between the upper and lower bands. Let’s comprehend this further:

- Upper Band: This band represents a level which is statistically high or overbought.

- Lower Band: Conversely, this band represents a level that is statistically low or oversold.

- Middle Line: This line is a Simple Moving Average – a standard method for tracking price over a specified period of time.

In essence, Bollinger Bands act as dynamic support and resistance levels that adapt to market conditions. Its foundation in statistical principles provides a level of reliability and can offer insightful perspectives into potential market behaviors.

Digging Deep Into Bollinger Bands: How They Work

Let’s sharpen those trading skills by deep-diving into the machinery behind Bollinger Bands. Imagine Bollinger Bands as three simple lines that trace the movement of a crypto coin’s price over time. But they’re much more than just lines, they’re also powerful predictors of price trends and volatility.

Components of Bollinger Bands

Bollinger Bands consist of three parts:

- The Middle Line: Also known as the ‘Simple Moving Average (SMA)’, it forms the base for the upper and lower bands. It is calculated by taking the average of the closing prices over a certain period, typically 20 periods.

- The Upper Band: This is calculated by adding two standard deviations to the moving average, highlighting potential ‘overbought’ situations.

- The Lower Band: This is found by subtracting two standard deviations from the moving average, spotlighting potential ‘oversold’ scenarios.

Understanding Standard Deviation

By now you’re probably wondering what a ‘standard deviation’ is. It’s a mathematical concept that measures the extent of variation or dispersion in a set of values. In terms of Bollinger Bands, a higher standard deviation results in wider bands, indicating a higher level of volatility. Conversely, a smaller standard deviation signals lower volatility, resulting in narrower bands.

Squeezes, Breakouts and Mean Reversion

How does one interpret the bands’ movement? One of the unique benefits of Bollinger Bands is their ability to capture a significant proportion of price action, which can provide keen insights:

- Squeezes: When the bands “squeeze” together, it suggests a period of low volatility is coming to an end, and a sharper price move is likely on the horizon. Traders watch for these squeezes as a potential signal for upcoming price breaks.

- Breakouts: When price moves outside of the upper or lower band, this suggests the currency is overbought or oversold respectively. Some traders look to sell when price breaks above the upper band and buy when it falls below the lower band.

- Mean Reversion: Prices often revert to the mean, or middle band. When the price moves considerably away from the middle band, it’s likely to return to it. This “reversion to mean” strategy forms the basis for many Bollinger Band trading systems.

In essence, Bollinger Bands are a dynamic tool that adapts to changing market conditions, providing you with robust indications of volatility and potential trading signals. With this foundation, let’s explore how you can integrate Bollinger Bands into your cryptocurrency trading strategy.

Bollinger Bands are a popular technical analysis tool used in cryptocurrency trading

Integrating Bollinger Bands into Your Trading: Step-by-Stepprocedure

Now that you’ve learned the basics of Bollinger Bands, let’s take a look at how you can incorporate them into your cryptocurrency trading strategy. Regardless of your trading goals or experience level, Bollinger Bands can provide valuable insights to guide your decision-making process.

Step 1: Set Up Bollinger Bands on Your Chart

To start with, you’ll need to apply Bollinger Bands to your chart. Most modern trading platforms, such as MetaTrader 4/5 and TradingView, come with Bollinger Bands pre-installed. You usually just need to select Bollinger Bands from the selection of indicators, then set your period to 20 and deviation to 2. Double-check to ensure that the middle line (the base line) is set to a simple moving average (SMA).

Step 2: Identify Squeezes and Breakouts

Once you’ve set up Bollinger Bands, it’s time to look for “squeezes”, which are periods where the Bollinger Bands move closer together, indicating lower volatility. This could precede a “breakout”, which is when the price moves sharply out of the Bollinger Bands. Remember, volatility tends to cycle from low to high and back again, so a squeeze could be a precursor to a big price move.

Step 3: Look for Mean Reversion Opportunities

Bollinger Bands can also be used to identify “mean reversion” opportunities. This is when the price has deviated significantly from the mean (the middle line of the Bollinger Bands) and might be expected to return to it. Think of the price as an elastic band — the further you pull it away from its rest position (the mean), the more it wants to snap back.

Step 4: Combine with Other Tools and Techniques

You shouldn’t rely solely on Bollinger Bands; instead, combine the technique with other tools and methods. For instance, you can use it in conjunction with the relative strength index (RSI) or moving average convergence divergence (MACD).

Remember to treat Bollinger Bands as what they are: one tool in a larger toolbox of technical analysis techniques. They’re a useful augment to other strategies and indicators, but they’re not a magic bullet that will make you rich overnight.

Step 5: Execute Your Trade and Monitor

Once your analysis is done and your strategy is set, execute your trade. However, your work is not done yet. It’s crucial to monitor your trade. Always be prepared to adjust or exit your position based on the evolving market situation. No strategy is foolproof, and market conditions can, and do, change rapidly.

So there you have it. By following these steps, you can integrate Bollinger Bands into your trading strategy to improve decision-making and potentially increase profits. As always, remember that trading comes with its own risks, so always trade responsibly.

Bollinger Bands Trading: Real-Life Examples and Success Stories

When it comes to applying Bollinger Bands in real trading scenarios, countless success stories dot the world of cryptocurrency trading. Let’s consider a few examples that emphasize how effective this indicator can be when used correctly.

Example 1: Anticipating Bitcoin’s Bull Run with Bollinger Bands

In the early months of 2020, many crypto traders used Bollinger Bands to anticipate an imminent bull run in Bitcoin. As the Bollinger Bands squeezed around the daily price of Bitcoin in the month of April, savvy traders could sense the brewing volatility. Alerted by the squeeze, they awaited the breakout. As expected, Bitcoin’s price broke out towards the end of April, triggering a bullish rally which saw the cryptocurrency’s value more than double in the subsequent months. This precise anticipation of a market movement shows the power of Bollinger Bands as a predictive tool.

Example 2: Ethereum and Mean Reversion

Ethereum’s rapid price rise in the middle of 2020 is another noteworthy example. Over the course of a few days, the Ethereum price hit the upper Bollinger Band several times, indicating the price was high relative to historical prices. A few savvy traders interpreted this as a possible over-extension of the price and decided to short Ethereum, banking on the principle of mean reversion. Soon enough, Ethereum reversed course and fell back towards the middle Bollinger Band, yielding profits for those who had anticipated the move.

Example 3: Identifying Trend Reversals with Litecoin

In late 2019, Litecoin exhibited a sustained price drop, with the price line almost glued to the lower Bollinger Band. This downtrend saw the digital asset’s value decrease for multiple weeks in a row. However, crypto market analysts watching the Bollinger Bands noticed widening bands hinting at an increase in volatility. As soon as the price touched the lower band and rebounded towards the middle moving average, they understood it as a potential trend reversal. Those who bought at this stage were rewarded, as Litecoin’s price started inching upwards shortly after, highlighting the Bollinger Band’s proficiency in identifying trend reversals.

These are just a few examples of how Bollinger Bands can be effectively used in cryptocurrency trading. From predicting volatility to identifying mean reversion opportunities, to spotting potential trend reversals, this versatile tool has proven its worth in various market conditions.

Conclusion: Taking Your Cryptocurrency Trading to the Next Level

With a firm understanding of Bollinger bands, you are now one step closer to refining your cryptocurrency trading strategy. However, remember that like any trading tool, these bands are not foolproof or standalone. They should be combined with other trading indicators, market analysis, and trading knowledge. As Bollinger himself pointed out, “Tags of the bands are just that, tags, not signals. A tag of the upper Bollinger Band is NOT in-and-of-itself a sell signal. A tag of the lower Bollinger Band is NOT in-and-of-itself a buy signal”. So, never rely solely on them to base your buying or selling decisions.

Keep in mind that always maintaining a robust risk management strategy is crucial in cryptocurrency trading. The markets are highly volatile and susceptible to significant price movements within short periods. Always be prepared for unexpected downturns by setting stop-loss orders and limiting your investment size to an amount you can afford to lose.

Bollinger Bands’ potential is evident when adequately used. They provide distinct insights into market volatility and price levels that could potentially yield profits. They are a trusted ally for those brave enough to venture into the dynamic cryptocurrency market, but their effectiveness ultimately depends on the skill and knowledge of the individual trader.

To truly take your trading to the next level, continual learning is key. Understand how different market conditions, economic indicators, and world events can influence cryptocurrency prices. This will enable you to adapt your strategies to align with these factors, potentially enhancing your ability to reap profitable trades.

Lastly, don’t forget the golden rule: practice makes perfect. Apply the Bollinger Bands trading strategy in a virtual or demo account first before diving in with real money. This practice will allow you to familiarize yourself with the strategy without risking actual funds. While making profitable trades can be fulfilling, each unsuccessful trade is a lesson in disguise, leading to better, more profitable decisions in the future.

Exploring the world of cryptocurrency trading using Bollinger Bands is an exciting journey, and we wish you every success on your trading adventure.

The stock market is filled with individuals who know the price of everything, but the value of nothing.

– Philip Fisher

Bollinger Bands are a popular technical analysis tool used in cryptocurrency trading