The Rising Trend of Cryptocurrency Marketplaces: Exploring Opportunities and Risks

Cryptocurrencies have gained significant traction in recent years, and with their increasing popularity, the demand for cryptocurrency marketplaces has soared. In this comprehensive guide, we will delve into the concept of cryptocurrency marketplaces, their types, key features, benefits, and potential risks. By understanding the dynamics of these marketplaces, you can make informed decisions and capitalize on the opportunities presented by the evolving world of cryptocurrencies.

See also : Trust Wallet: The Ultimate Guide to Secure and Convenient Crypto Management

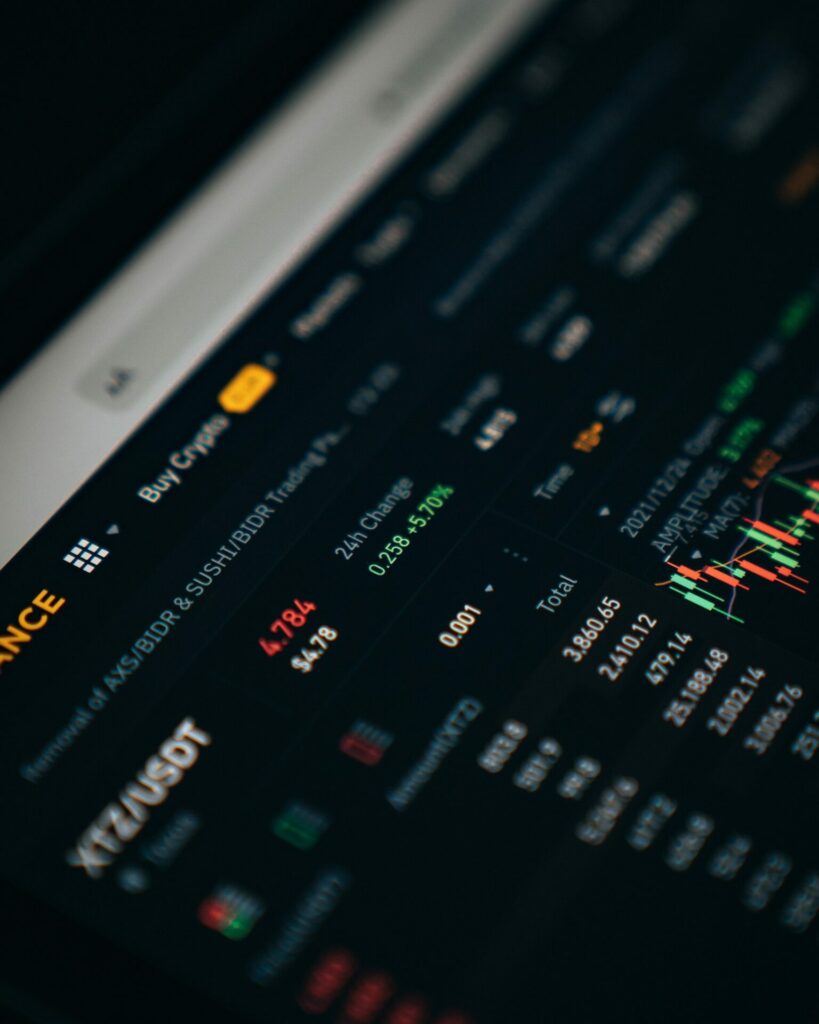

Growth and Popularity of Cryptocurrency Marketplaces

Cryptocurrency marketplaces have witnessed remarkable growth over time. Initially, they were scarce, but with the rising demand for cryptocurrencies, numerous marketplaces emerged. This surge can be attributed to factors such as the increased awareness and acceptance of digital currencies, the potential for substantial returns on investment, and the convenience of trading through online platforms. The growing popularity of cryptocurrencies as a digital asset class has further fueled the demand for these marketplaces.

Types of Cryptocurrency Marketplaces

Cryptocurrency marketplaces can be broadly categorized into two types: centralized and decentralized. Centralized marketplaces, operated by a single entity, act as intermediaries between buyers and sellers. They offer features such as user-friendly interfaces, enhanced security measures, and customer support. Popular examples include Binance, Coinbase, and Kraken. On the other hand, decentralized marketplaces operate on blockchain technology, allowing for peer-to-peer transactions without intermediaries. These marketplaces offer greater privacy, control over funds, and the potential for innovation. Notable examples include Uniswap, SushiSwap, and PancakeSwap.

Key Features and Functionality of Cryptocurrency Marketplaces

Cryptocurrency marketplaces provide a range of features and functionalities to facilitate seamless trading experiences. User registration and account management processes allow individuals to create accounts, verify identities, and manage their profiles efficiently. Cryptocurrency trading and exchange platforms enable users to buy, sell, and trade a variety of digital assets. Security measures, such as two-factor authentication and encryption, ensure the safety of user funds. Payment methods and transaction processing mechanisms offer convenience and flexibility. Order books and trading charts provide real-time market data and insights for making informed trading decisions. Furthermore, cryptocurrency marketplaces often offer additional services like margin trading, staking, and lending to cater to diverse user needs.

Benefits and Advantages of Cryptocurrency Marketplaces

Cryptocurrency marketplaces offer numerous benefits and advantages to both novice and experienced traders. Firstly, increased liquidity and trading volume ensure that buyers and sellers can find matches for their desired trades promptly. Access to a wide range of cryptocurrencies allows for portfolio diversification and investment opportunities across various digital assets. Real-time trading opportunities enable users to capitalize on market fluctuations and make timely investment decisions. Enhanced security measures, including cold storage and regular security audits, instill confidence and protect user funds. Lastly, the global accessibility and borderless nature of cryptocurrency marketplaces facilitate frictionless transactions across geographical boundaries.

Challenges and Risks in Cryptocurrency Marketplaces

While cryptocurrency marketplaces offer exciting opportunities, they are not without risks and challenges. Security vulnerabilities and hacking risks remain a concern, and users must exercise caution and adopt robust security practices to protect their funds. Regulatory and legal considerations vary across jurisdictions, and compliance with applicable laws is essential for marketplace operators and users alike. Price manipulation and fraudulent activities can occur due to the decentralized nature of some marketplaces, emphasizing the importance of due diligence and research. Transparency and trust issues can also arise, requiring users to thoroughly assess the reputation and credibility of a marketplace before engaging in transactions.

Factors to Consider When

Choosing a Cryptocurrency Marketplace

Selecting the right cryptocurrency marketplace is crucial for a secure and seamless trading experience. Here are some essential factors to consider:

- Reputation and User Reviews: Research the marketplace’s reputation and read user reviews to gauge its reliability, trustworthiness, and track record in the industry. Look for feedback regarding security, customer support, and overall user satisfaction.

- Security Measures and Safeguards: Ensure that the marketplace implements robust security measures, such as two-factor authentication, encryption, and cold storage of funds. Look for platforms that conduct regular security audits and prioritize the safety of user assets.

- Supported Cryptocurrencies and Trading Pairs: Evaluate the range of cryptocurrencies supported by the marketplace. A diverse selection of cryptocurrencies and trading pairs will provide you with more options for investment and trading strategies.

- Liquidity and Trading Volume: Consider the liquidity and trading volume on the marketplace. Higher liquidity ensures that you can easily buy or sell your desired cryptocurrencies at competitive prices, while increased trading volume indicates active participation and potentially better market efficiency.

- User Interface and Ease of Use: A user-friendly interface and intuitive trading platform are essential for a seamless experience. Look for a marketplace with clear navigation, well-designed charts, and an easy-to-understand order placement process.

- Customer Support and Responsiveness: Evaluate the quality and responsiveness of customer support services. Prompt assistance is crucial in case of any issues or queries that may arise during your trading journey.

Conclusion

Cryptocurrency marketplaces play a vital role in facilitating the buying, selling, and trading of digital assets. By understanding the growth, types, features, benefits, and risks associated with these marketplaces, you can make informed decisions and maximize the opportunities presented by the evolving world of cryptocurrencies. Remember to conduct thorough research, prioritize security, and consider the factors discussed when choosing a reliable and suitable cryptocurrency marketplace. Embark on your cryptocurrency trading journey with confidence, always staying updated on regulatory developments and industry trends.

And for those of you who want to grow your Instagram account, you can directly use our service free instagram followers and you can like your post on instagram with Free instagram likes feature